Dr Nishi Malhotra*

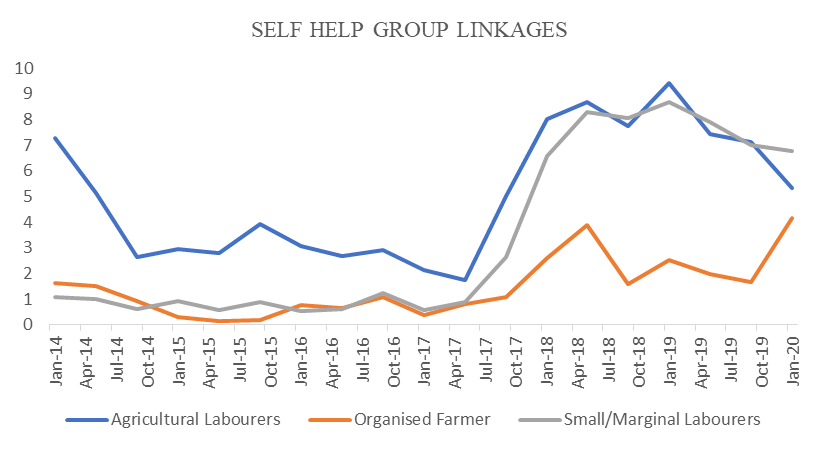

The Modi government’s commitment to the upliftment of marginalized and disadvantaged communities is evident through a myriad of social schemes aimed at achieving the UN Sustainable Development Goals. These initiatives not only focus on equity and inclusiveness but also prioritize women’s empowerment, fostering a more inclusive and prosperous society. The lack of institutional credit delivery has been a significant impediment to agricultural growth, leading to a dependency on non-institutional credit sources such as moneylenders. This has posed a challenge for small farmers in India. In response, the Government of India introduced the Kisan Credit Card (KCC) scheme under the aegis of the Reserve Bank of India to provide institutional credit to farmers in a streamlined and efficient manner. The KCC scheme plays a crucial role in providing timely institutional credit under a single window, offering a hassle-free process for farmers. The scheme also provides interest subvention and incentives for early loan repayment, further incentivizing farmers to avail of the benefits. With approximately 6.93 Crore KCCs issued to date, the scheme has significantly contributed to augmenting agricultural credit, increasing farmers’ income, and boosting crop productivity. Despite the scheme’s benefits, challenges persist. Financial exclusion, lack of literacy, small land holdings, and absence of bank accounts continue to hinder the full adoption of KCCs, especially among small and marginal farmers with land holdings of less than 2 acres. These farmers are particularly vulnerable to natural calamities and have limited access to financial resources. To address these challenges, concerted efforts have been undertaken by organizations such as NABARD, the RBI, and the Government of India. Initiatives include financial literacy campaigns, facilitating prompt opening of bank accounts, waiving financial charges, and cross-selling various financial products, including health and crop insurance. Additionally, specific provisions for tenant farmers, self-help groups, and joint liability groups have been introduced to make the benefits of the KCC scheme. Numerous studies have highlighted the direct correlation between improved access to institutional credit and enhanced productivity and incomes among farmers. Access to institutional credit not only enables farmers to invest in quality inputs and modern farming techniques but also enhances their overall agricultural practices, resulting in a sustainable increase in yields and incomes within the farming community. Furthermore, the pivotal role of markets in determining fair prices and fostering economic growth has been emphasized by various agencies and researchers. Efficient and transparent market mechanisms play a crucial role in providing farmers with a platform to sell their produce at remunerative prices, thereby contributing to the overall economic upliftment of the agricultural sector. Despite the proven benefits of institutional credit and market access, there exist significant challenges hindering the widespread adoption of schemes like the Kisan Credit Card (KCC) among farmers. Recognizing these challenges, the Government has embarked on various initiatives to promote the adoption of KCCs and address the barriers faced by farmers. Several agricultural initiatives have been executed during the Modi administration in an effort to facilitate sector transformation, improve farmer welfare, increase productivity, and ensure sustainable development. Key agricultural initiatives initiated by the Modi administration include Pradhan Mantri Fasal Bima Yojana. The PMFBY is a crop insurance program that provides producers with financial assistance in the event that their crops fail as a result of natural disasters, pests, or diseases. While promoting sustainable agricultural practices, it provides comprehensive risk coverage. To ensure farmers’ produce is sold at remunerative prices, PM-AASHA is an umbrella program consisting of the Price Support Scheme (PSS), the Price Deficiency Payment Scheme (PDPS), and the Pilot of Private Procurement & Stockist Scheme (PPPS). E-NAM is a nationwide online trading platform that facilitates transactions between agricultural produce market committees (APMCs). It grants producers access to a broader market, facilitates the online sale of their produce, and attains higher prices for their crops. PM-KISAN is an income support program that transfers Rs. 6,000 in direct income support to the bank accounts of small and marginal farmers annually in three equal installments. This initiative seeks to guarantee producers’ financial stability. PMKSY is committed to delivering water management solutions that increase irrigation coverage and optimize agricultural water use. It seeks to guarantee “Har Khet Ko Pani” (access to water for all fields). These schemes have helped the small farmers with a lack of collateral to access credit from formal sources. The Government under the leadership of PM Modiji has given impetus to the formation of FPOs (Farmer Producer Organizations) to promote sustainable farming and livelihood opportunities. Since 2014, when the “Equity Grant and Credit Guarantee scheme” was introduced, the borrowings of FPOs (Farmer Producer Companies) from the banks have increased steadily. For the Small and Marginal farmers, there are many obstacles, in the form of structural rigidities and formalities to seek bank loans. With various Interest subventions and debt waiver schemes, the Government of India tried to give a push to agricultural credit for Small and Marginal farmers. Various subsidy- linked insurance schemes, including the Personal Accident Insurance Scheme and Rashtriya Krishi Vikas Yojana have been introduced to give an impetus to Formal agriculture credit. Despite, all efforts due to the lack of land records and the Scale of the Finance based credit system, borrowings by the Small and Marginal Farmers saw a downward trend. Consumer pyramid dx dataset was considered for analysis. According to data Agricultural Labourers who form 19.99% of the total dataset are marginalized and have to rely on informal sources of finance to meet their credit needs. The major finding of the report is that since 2017, the borrowings under the DAY NRLM (Deen Dayal Antodaya National Rural Livelihood Mission) has seen an upward trend. After a decline in 2016 during the Demonetization phase, the programme took a fillip in the year 2017, due to the Financial Literacy Camps and awareness drives undertaken under the mandate of RBI by the Financial Literacy Centres and Rural Bank Branches. Further simplification of the documentation and forms for availing loans under SHG linkage, removal of the service and processing charges and inclusion of SHG lending under state, block and district plans expedited the lending from April 2017 to May 2018. In 2018, the Government of India in its budget has announced the extension of Overdraft facility of up to Rs 5,000 and a loan of Rs. 1 Lakh, under the MUDRA scheme to the eligible members of the SHG group having Bank Accounts. Since then, Government of India, has introduced various other schemes such as Nari Shakti, Ajeevika, PM Jan Jati mission to give impetus to financial inclusion through self help group bank linkage programme. The analysis of the data showed that since 2017, the percentage of rural households covered by the self-help group linkage programme has increased drastically. Graph 1 shows the percentage of households covered under the self-help group linkage programme since January 2014 to January 2020.

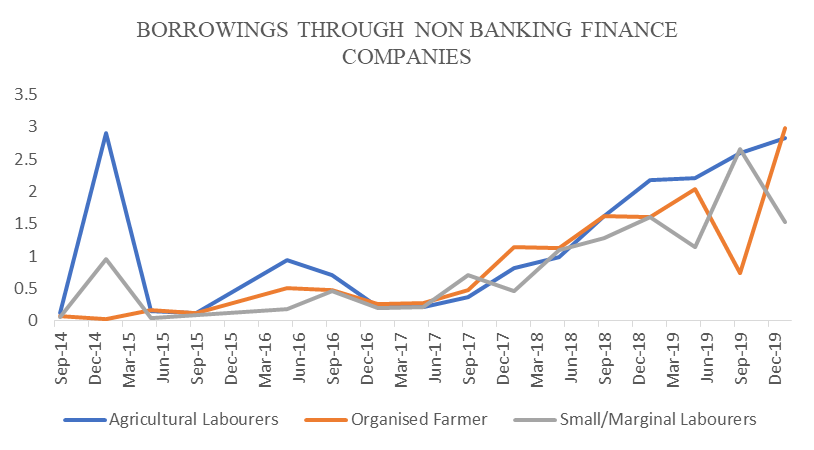

Similarly, as per 2018 mandate by RBI (Reserve Bank of India) set up NBFC (Non-Banking Financial Companies) for the purpose of infrastructure lending includes projects that involve (I) construction relating to projects involving agro-processing and supply of inputs to agriculture; (ii) construction for preservation and storage of processed agro-products, perishable goods such as fruits, vegetables and flowers including testing facilities for quality; and (iii) construction of educational institutions and hospitals. The above change comes into effect immediately. Post Demonetization there is a clear upward trend in borrowings by the Agricultural Labourers from Non-Banking Financial Companies due to favorable policy initiatives by Government of India and RBI (Reserve Bank of India). Graph 2 shows the percentage of rural households that borrow from non banking finance companies.

Figure 2: Borrowings through Non-Banking Finance Companies

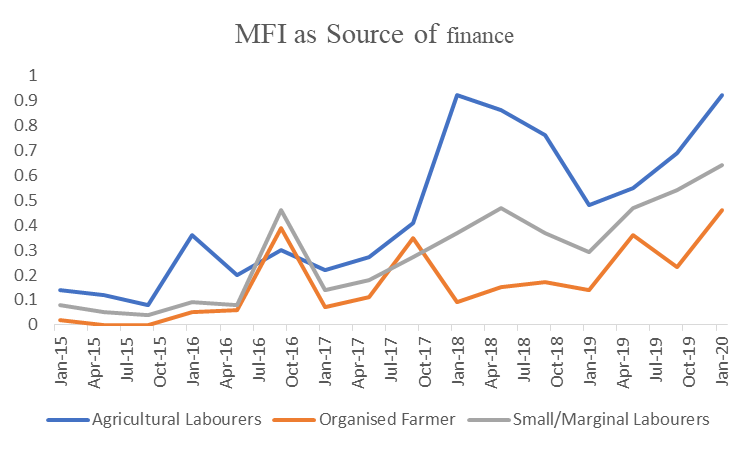

Just as NBFCs, MFIs (Micro Finance Institutions), also raise money from the banks and provide credit to the Small and Marginal farmers at a higher interest rate. Small farmers, who are unable to raise money from the Banks owing to the requirement of collateral and income, end up borrowing from these agencies. Due to this agricultural labourers are more prone to borrow from the MFIs (Micro Finance Institutions). Demonetization effect is also applicable to the rural lending by these institutions. Microfinance schemes to facilitate finance without collateral at easy terms have seen further impetus through the MFIs (Microfinance institutions).

The Government of India has undertaken various other financial literacy programmes to ensure the financial inclusion of the marginalized poor farmers, and labourers. Besides that the Government of India has under taken the PM Kisan Samman Nidhi Yojana. This program provides small and marginal producers with direct income support in the form of an annual transfer of Rs. 6,000 divided into three equal instalments. Many more programmes such as Paramparagat Krishi Vikas Yojana to promote organic farming and promote sustainable farming.

In a nutshell the visionary initiatives implemented by Prime Minister Narendra Modi to support farmers are crucial in transforming the agricultural industry and bolstering the fundamental sector of the Indian economy. Through the consideration and implementation of critical elements including financial inclusion, income security, crop protection, market accessibility, and sustainable agricultural practices, these endeavors not only improve the quality of life for farmers but also foster the expansion and durability of the agricultural sector as a whole, thus establishing a prosperous and resilient farming community.

Leave a Reply